heyco-instrument.ru

Overview

Current 30 Year Fixed Loan

National year fixed mortgage rates go down to %. The current average year fixed mortgage rate fell 1 basis point from % to % on Wednesday. A loan used for purchasing or refinancing a home with an interest rate that never changes and a repayment term of thirty years. Today. The average APR for the benchmark year fixed-rate mortgage fell to %. Last week. %. year. Year Fixed Mortgage Rates* ; , % ; , % ; , % ; , %. Year Fixed Rate ; Rate: % ; APR: % ; Points ; Estimated Monthly Payment: $1, Today's year mortgage rates can be customized from major lenders. NerdWallet's 30 yr mortgage rates are based on a daily survey of national lenders. Today's year fixed mortgage rates ; Conventional fixed-rate loans · year. %. %. $2, ; Conforming adjustable-rate mortgage (ARM) loans · 10/6 mo. The best way to get your current mortgage rate is to let us estimate it based on your unique details. Learn About Year Fixed Loans. Year Fixed. Rate%. /. Conforming and Government LoansExpand Opens DialogExpand · Year Fixed Rate · Interest% · APR%. National year fixed mortgage rates go down to %. The current average year fixed mortgage rate fell 1 basis point from % to % on Wednesday. A loan used for purchasing or refinancing a home with an interest rate that never changes and a repayment term of thirty years. Today. The average APR for the benchmark year fixed-rate mortgage fell to %. Last week. %. year. Year Fixed Mortgage Rates* ; , % ; , % ; , % ; , %. Year Fixed Rate ; Rate: % ; APR: % ; Points ; Estimated Monthly Payment: $1, Today's year mortgage rates can be customized from major lenders. NerdWallet's 30 yr mortgage rates are based on a daily survey of national lenders. Today's year fixed mortgage rates ; Conventional fixed-rate loans · year. %. %. $2, ; Conforming adjustable-rate mortgage (ARM) loans · 10/6 mo. The best way to get your current mortgage rate is to let us estimate it based on your unique details. Learn About Year Fixed Loans. Year Fixed. Rate%. /. Conforming and Government LoansExpand Opens DialogExpand · Year Fixed Rate · Interest% · APR%.

year Fixed-Rate Loan: An interest rate of % (% APR) is for the cost of point(s) ($5,) paid at closing. On a $, mortgage, you would. Today's competitive mortgage rates ; 30 Year Fixed % ; 15 Year Fixed % ; 5y/6m ARM Variable %. 30 Year Mortgage Rate in the United States averaged percent from until , reaching an all time high of percent in October of The current mortgage rates stand at % for a year fixed mortgage and % for a year fixed mortgage as of September 03 pm EST. Terms of Service and Privacy Policy. › Mortgages; ›. Compare Current Mortgage Showing: Purchase, Good (), year fixed, Single family home, Primary. Know what the current mortgage interest rates are today, or get your own custom home mortgage rate 30 year Fixed rate mortgage with an interest rate of %. A loan used for purchasing or refinancing a home with an interest rate that never changes and a repayment term of thirty years. Mortgage rates today ; yr fixed · % · % · ($3,) ; yr fixed FHA · % · % · ($4,) ; yr fixed · % · % · ($3,). 30 Yr. Jumbo, %, --, %. year fixed mortgage rates for September 3, ; year fixed VA ; year fixed VA, %, % ; Rates are provided by our partner network, and may not. See the mortgage rate a typical consumer might see in the most recent Primary Mortgage Market Survey, updated weekly. The PMMS is focused on conventional. Today's competitive mortgage rates ; year · % · % ; year · % · % ; year · % · % ; 10y/6m · % · % ; 7y/6m · % · %. Today's rates for year fixed-rate mortgages are in the upper 6% to low 7% range for buyers with excellent credit. How Can I Find. Compare our current interest rates ; year fixed, %, % ; year fixed, %, % ; FHA loan, %, % ; VA loans, %, %. year mortgage rates currently average % for purchase loans and % for refinance loans. · Mortgage Purchase rates in Charlotte, NC · Current year. A year fixed-rate mortgage is the most common mortgage loan option. It has a repayment period of 30 years and the interest rate doesn't change throughout the. The year fixed mortgage rate on September 4, is down 1 basis point from the previous week's average rate of %. Additionally, the current national. (1) Your loan is one of the following fixed-rate mortgage loan products: Homebuyers Choice, Military Choice, or and year Jumbo Fixed loans (collectively. Personalize your rate ; 15 Year Fixed. $2, · % ; 20 Year Fixed. $2, · % ; 30 Year Fixed. $2, · %. View data of the average interest rate, calculated weekly, of fixed-rate mortgages with a year repayment term.

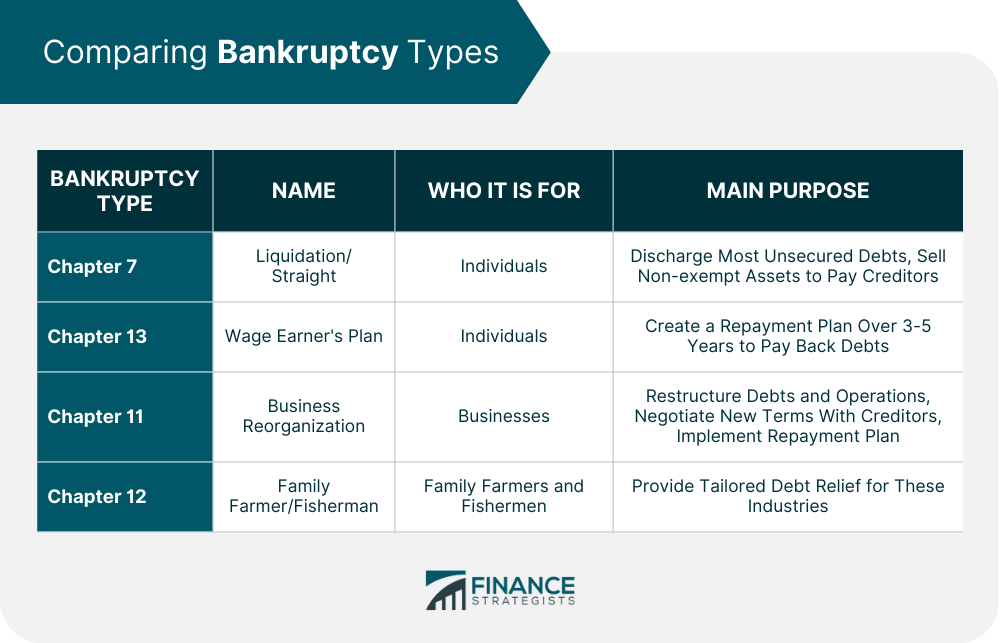

Personal Bankruptcy Definition

However, it is important to note that there are certain types of debts that are excluded from discharge (meaning they are not cleared and you are still. When your creditors force you to, it is forced bankruptcy. Forced bankruptcy does not happen often. Requirements for Personal Bankruptcy. To go bankrupt, a. Personal bankruptcy law allows, in certain jurisdictions, an individual to be declared bankrupt. Virtually every country with a modern legal system features. A bankruptcy case in which the debtor is a business or an individual with business related debt. Data from the U.S. Administrative Office of the Courts. Individual debtors get their discharge within months of filing the case. The discharge eliminates personal liability for dischargeable debts that existed at. Accordingly, bankruptcy proceedings are viewed as general or universal collection procedures as distinguished from individual collection remedies available to. Bankruptcy is a legal process for getting relief from debts that you cannot repay. If you file for personal bankruptcy, you generally have two options: Chapter. Bankruptcy gives creditors an opportunity for repayment when assets belonging to an individual or business are liquidated. All bankruptcy cases are filed in. Bankruptcy is a process in federal court that helps people who owe money get relief from debts they cannot pay. This guide can help you. However, it is important to note that there are certain types of debts that are excluded from discharge (meaning they are not cleared and you are still. When your creditors force you to, it is forced bankruptcy. Forced bankruptcy does not happen often. Requirements for Personal Bankruptcy. To go bankrupt, a. Personal bankruptcy law allows, in certain jurisdictions, an individual to be declared bankrupt. Virtually every country with a modern legal system features. A bankruptcy case in which the debtor is a business or an individual with business related debt. Data from the U.S. Administrative Office of the Courts. Individual debtors get their discharge within months of filing the case. The discharge eliminates personal liability for dischargeable debts that existed at. Accordingly, bankruptcy proceedings are viewed as general or universal collection procedures as distinguished from individual collection remedies available to. Bankruptcy is a legal process for getting relief from debts that you cannot repay. If you file for personal bankruptcy, you generally have two options: Chapter. Bankruptcy gives creditors an opportunity for repayment when assets belonging to an individual or business are liquidated. All bankruptcy cases are filed in. Bankruptcy is a process in federal court that helps people who owe money get relief from debts they cannot pay. This guide can help you.

Bankruptcy is a legal process by which an individual or business, called the debtor, can petition the courts for relief from debts they're unable to pay. A debtor may file for bankruptcy, which is called “voluntary bankruptcy,” or a creditor may petition the court to declare the debtor bankrupt, which is called “. At the end of the bankruptcy, most debts are cancelled. How you become bankrupt. The High Court can declare you bankrupt by making a 'bankruptcy order' after. After the bankruptcy process is complete, the court will remove your liability for certain debts. This is called debt discharge. Is Bankruptcy a Good Idea for. One of the primary purposes of bankruptcy is to discharge certain debts to give an honest individual debtor a "fresh start." The debtor has no liability for. Dismissal: IRS may keep payments, and time in bankruptcy extends time to collect remaining tax liabilities. Discharge: Will eliminate (discharge) personal. Under Chapter 7 bankruptcy, you ask the bankruptcy court to discharge the debts you owe, meaning you don't have to pay them anymore. People with no steady. Chapter 13 bankruptcy puts the filer on a repayment plan and can help protect assets like a home. The goal of personal bankruptcies like Chapter 7 and 13 is to. “Bankruptcy” is a federal law that establishes an orderly process to provide protection to debtors and fair treatment to creditors. Bankruptcy proceedings. A discharge releases you (the debtor) from personal liability for certain dischargeable debts. Some taxes may be dischargeable. Whether a federal tax debt may. Bankruptcy law provides for the reduction or elimination of certain debts, and can provide a timeline for the repayment of nondischargeable debts over time. Chapter 7 provides for the discharge of unsecured debt, such as debt from credit cards and personal loans. Secured debt is typically unaltered, meaning that. Bankruptcy gives creditors an opportunity for repayment when assets belonging to an individual or business are liquidated. All bankruptcy cases are filed in. Personal bankruptcy permits debtors to change or let go of debts they can't pay and allows for creditors to collect at least some of what is owed. The legal process of bankruptcy features a “stay of proceedings” that prevents a garnishment or any legal action from taking place and stops your creditors from. Bankruptcy is a legal process where you're declared unable to pay your debts. It can release you from most debts and allow you to make a fresh start. It allows a wage earner (individual debtor) to propose a plan to pay his/her creditors in full or in part. Chapter 13 differs from Chapter 11 in that a plan is. Chapter 7 Bankruptcy In a so called "straight" bankruptcy, the Trustee in bankruptcy seeks to liquidate the debtor's non exempt property and distribute the. They were facing foreclosure on their homes and personal bankruptcy. Christianity Today. There may have been a time when banks, mortgage companies and other. Further, a bankruptcy court may dismiss a chapter 7 case if the individual debtor's debts are primarily consumer rather than business debts. This dismissal is.

Technology In The Music Industry

Modern technology is continuously moving the needle forward, especially in music. It changes how we're able to listen to music and how we connect with the. (With Studies in Music Industry & Recording Technology). A student and instructor sit before an audio mixer with hands on the slider control knobs. Program Type. Career Roles · Composer (Video Games) · Creative Entrepreneur · Data Analyst · Digital Content Producer · Digital Product Designer · Electronic Musician · Interactive. Music Tech STARTUPS · f7 Ventures. . VC.) · a16z Cultural Leadership Fund. . VC.) · Zagaz Conscious Investments. . VC.) · Yann Miossec. . Angel Investor.). Over the last fifty years, the use of computers to generate sound has evolved into what is today's popular mainstream music. Format, mediums, performance, and. In USD's B.S. in music with a specialization in industry and technology, you'll have the opportunity to blend musical and technical knowledge as you prepare for. Already the buzzword of the year, it's crucial to see how artificial intelligence (AI) could impact the music industry and its different. This chapter will examine the impact of the Internet on the music industry and present the state of the music industry in an age of digital distribution. Technology has changed the world and made it better in countless ways and so has music done for thousands of years. But there are also some disadvantages. Modern technology is continuously moving the needle forward, especially in music. It changes how we're able to listen to music and how we connect with the. (With Studies in Music Industry & Recording Technology). A student and instructor sit before an audio mixer with hands on the slider control knobs. Program Type. Career Roles · Composer (Video Games) · Creative Entrepreneur · Data Analyst · Digital Content Producer · Digital Product Designer · Electronic Musician · Interactive. Music Tech STARTUPS · f7 Ventures. . VC.) · a16z Cultural Leadership Fund. . VC.) · Zagaz Conscious Investments. . VC.) · Yann Miossec. . Angel Investor.). Over the last fifty years, the use of computers to generate sound has evolved into what is today's popular mainstream music. Format, mediums, performance, and. In USD's B.S. in music with a specialization in industry and technology, you'll have the opportunity to blend musical and technical knowledge as you prepare for. Already the buzzword of the year, it's crucial to see how artificial intelligence (AI) could impact the music industry and its different. This chapter will examine the impact of the Internet on the music industry and present the state of the music industry in an age of digital distribution. Technology has changed the world and made it better in countless ways and so has music done for thousands of years. But there are also some disadvantages.

Technology has altered the structure of the industry, and the role of the artist has shifted as a result. From vinyl records to music streaming, the way society. In this blog post, we will explore how technology is reshaping the music industry and what it means for artists, record labels, and consumers alike. Digital software has arguably been the biggest game-changer in the production of music, allowing musicians of all abilities to write, record and produce their. Career Roles · Composer (Video Games) · Creative Entrepreneur · Data Analyst · Digital Content Producer · Digital Product Designer · Electronic Musician · Interactive. Over the last fifty years, the use of computers to generate sound has evolved into what is today's popular mainstream music. Format, mediums, performance, and. AI is already being used to assist in the production of music — with automated mixing tools and mastering software — helping to streamline the. Music technology includes producing music, recording, mixing, mastering, game audio, post-production sound, live sound reinforcement, synthesis, sampling and. Many new musical trends will be shaped by technology in the music industry. For example, according to some projections, AI created music could create a huge. Perhaps the most significant impact of the digital revolution on the music industry has been the role of the internet in music distribution and promotion. The. TEC Tracks will offer more than 50 sessions of expert insights across a wide path - from pro audio to music technology to critical and dynamic aspects of the. The music industry has come a long way from the analog days. Technology has allowed for the digitalization of music. It has removed the limitations of. Music changes because of technology constantly, whether it be the efficiency of learning music theory basics, the DIY market making it easier to. Digital technology advancements led to significant shifts in many aspects of the music business. 20K subscribers in the musicindustry community. news and discussions related to the music industry. An investigation into technological changes and the relation between the economic and cultural aspec The findings suggest that modern technologies have. These instruments vary, including computers, electronic effects units, software, and digital audio equipment. Digital music technology is used in performance. Music technology is the study or the use of any device, mechanism, machine or tool by a musician or composer to make or perform music; to compose, notate. Each of the technological innovations covered in this book not only disrupted the music business, but also fundamentally altered the industry's character. And. Digital recording: With the advent of digital recording, musicians can create high-quality recordings using software-based programs that allow. Key participants in the music industry, including artists and labels, are benefiting from new tech - which is also stimulating rising demand for music.

Apr Vs Annual Fee

This tool shows the tradeoff in holding a no-annual fee card with a higher interest rate versus an annual fee card with a lower rate. Credit cards charge interest like other loans, typically expressed as an annual percentage rate or APR. Because of this, if balances on your card aren't paid. The primary difference between APR and interest rate is that the APR reflects the interest rate plus additional costs that may apply to your loan. Credit cards with no annual fee generally require a lower credit score than those with an annual fee, meaning they are easier to get approved for. No annual fee. 0% introductory APR for the first 12 billing cycles on balance transfers made in the first 60 days. After that. The Annual Percentage Rate (APR) refers to the yearly cost of a loan, including the interest plus other fees the lender charges. In other words, the APR. APR vs. APY While APR is how much you owe on a balance, annual percentage yield (APY) refers to how much an interest-bearing account, such as a savings. This tool shows the tradeoff in holding a no-annual fee card with a higher interest rate versus an annual fee card with a lower rate. An APR is your interest rate for an entire year, along with any costs or fees associated with your loan. That means an APR presents a more complete picture of. This tool shows the tradeoff in holding a no-annual fee card with a higher interest rate versus an annual fee card with a lower rate. Credit cards charge interest like other loans, typically expressed as an annual percentage rate or APR. Because of this, if balances on your card aren't paid. The primary difference between APR and interest rate is that the APR reflects the interest rate plus additional costs that may apply to your loan. Credit cards with no annual fee generally require a lower credit score than those with an annual fee, meaning they are easier to get approved for. No annual fee. 0% introductory APR for the first 12 billing cycles on balance transfers made in the first 60 days. After that. The Annual Percentage Rate (APR) refers to the yearly cost of a loan, including the interest plus other fees the lender charges. In other words, the APR. APR vs. APY While APR is how much you owe on a balance, annual percentage yield (APY) refers to how much an interest-bearing account, such as a savings. This tool shows the tradeoff in holding a no-annual fee card with a higher interest rate versus an annual fee card with a lower rate. An APR is your interest rate for an entire year, along with any costs or fees associated with your loan. That means an APR presents a more complete picture of.

The APR provides a clearer understanding of what you'll repay, as it includes additional fees. For example, you might find a credit card with an annual interest. APR is short for Annual Percentage Rate and is a mix of different fees and interest you pay for the right to borrow money. The APR you receive is based on your. APR calculations are usually based on your card purchase interest rate. Annual or application fees are included in the APR calculation. The estimated cost. Rate. Variable APR as low as. %. Annual fee: $0. Features. Our lowest rate card; No nonsense simplicity; Best for users who carry a balance. Apply now Card. An APR is a number that represents the total yearly cost of borrowing money, expressed as a percentage of the principal loan amount. %, % or % variable APR thereafter. Balance transfers made within days from account opening qualify for the introductory rate. Annual fee. $0. A credit card's APR (annual percentage rate) is the total cost of its interest rate (eg 20%) plus the fees every cardholder pays as standard, such as the. Annual percentage rate (APR) is the yearly interest and any fees owed on debt APR vs. interest rate. It's easy to lump interest rate and APR into the. Annual Percentage Rate, or APR, refers to the total cost of borrowing, as the calculation for APR includes not only the interest rate, but also many other fees. APR is short for Annual Percentage Rate and is a mix of different fees and interest you pay for the right to borrow money. The APR you receive is based on your. While the interest rate determines the cost of borrowing money, the annual percentage rate (APR) is a more accurate picture of total borrowing cost because it. Annual Percentage Rate. It is the amount of interest you will pay on a given balance over the course of a year if you pay less than the. APR, or annual percentage rate, represents the annual cost of borrowing money, including fees, expressed as a percentage; for credit cards, APR is generally. A credit card's APR is its annual interest rate. If you lose your card's fee of 3% to 5%. Another option is to get a debt consolidation loan with a. The term annual percentage rate of charge (APR), corresponding sometimes to a nominal APR and sometimes to an effective APR (EAPR), is the interest rate for. Annual percentage rate (APR) is the yearly interest and any fees owed on debt APR vs. interest rate. It's easy to lump interest rate and APR into the. The APR provides a clearer understanding of what you'll repay, as it includes additional fees. For example, you might find a credit card with an annual interest. A low-interest card might offer a 15 percent Annual Percentage Rate (APR), and a rewards card that offers 1 percent cash back might have an APR of 18 percent. This small but ubiquitous acronym stands for Annual Percentage Rate and it measures the annualized cost of borrowing credit. APR is generally determined as a. APR means Annual Percentage Rate. It's the cost of borrowing money over a year on a credit card or loan. It takes into account interest, as well as other.

Variable Annuity Withdrawal Taxation

Overall, if an annuitant withdraws money from an annuity prior to age 59 ½, then he or she will likely be required to pay a 10% penalty on the taxable portion. This tax applies to the part of the distribution that you must include in gross income. It doesn't apply to any part of a distribution that is. When you withdraw your money, however, you will pay tax on the gains at ordinary federal income tax rates rather than lower capital gains rates. Under certain. Income taken from a deferred annuity, such as a variable annuity or fixed index annuity, is typically taken in the form of a systematic withdrawal from the. Annuities grow tax-deferred. When you begin withdrawing money from your fixed index or multi-year annuity, taxes become due on the earnings portion of the. No taxes are owed on money that accrues in a qualified account as long as no withdrawals are made. Types of Qualified Annuities. Qualified annuities are often. The earnings aren't taxed until distributed either in a withdrawal or in annuity payments. The taxable part of a distribution is treated as ordinary income. Annuities are designed to function as retirement investment vehicles, placing withdrawals after the attained age of 59 1/2. Should the annuity owner begin. Once you begin taking withdrawals or receiving payments from a non-ROTH qualified annuity, the money received becomes fully taxable as income. The reason for. Overall, if an annuitant withdraws money from an annuity prior to age 59 ½, then he or she will likely be required to pay a 10% penalty on the taxable portion. This tax applies to the part of the distribution that you must include in gross income. It doesn't apply to any part of a distribution that is. When you withdraw your money, however, you will pay tax on the gains at ordinary federal income tax rates rather than lower capital gains rates. Under certain. Income taken from a deferred annuity, such as a variable annuity or fixed index annuity, is typically taken in the form of a systematic withdrawal from the. Annuities grow tax-deferred. When you begin withdrawing money from your fixed index or multi-year annuity, taxes become due on the earnings portion of the. No taxes are owed on money that accrues in a qualified account as long as no withdrawals are made. Types of Qualified Annuities. Qualified annuities are often. The earnings aren't taxed until distributed either in a withdrawal or in annuity payments. The taxable part of a distribution is treated as ordinary income. Annuities are designed to function as retirement investment vehicles, placing withdrawals after the attained age of 59 1/2. Should the annuity owner begin. Once you begin taking withdrawals or receiving payments from a non-ROTH qualified annuity, the money received becomes fully taxable as income. The reason for.

variable annuity and may be subject to conditions and limitations. On the surface, gains withdrawn from annuities are taxed as ordinary income with rates as. Unlike withdrawals, the contract owner does not pay full taxes on the payments. Annuity payments are taxable to the extent that they represent interest earned. The tax consequences and long holding periods necessary to make a deferred or variable annuity attractive are investment options that probably do not make sense. When it comes to taxation on your non-qualified annuity, withdrawals come first from any earnings, which are taxed at your ordinary income rate. Once all the. If you're younger than 59½ and withdraw money from your annuity, the IRS will apply a 10% federal tax penalty on the taxable portion of the withdrawal, unless. Generally, annuity withdrawals are subject to income tax, with a portion potentially being taxed as ordinary income. It is advisable to consult a tax. This means they tax nonqualified annuity withdrawals as income until the withdrawal amount exceeds the annuity's growth. variable annuity that has not. Variable annuities generally are not taxed until you withdraw the money and the taxation will depend on how you made your initial investment and how you take. When you do pay taxes, your annuity income is taxed as regular income. This means that the tax rate depends on how much income you earned and which tax bracket. If an annuitant surrenders their variable annuity contract, the full cash value would be taxable including portion deducted for the surrender charge. If the. If you're younger than 59½ and withdraw money from your annuity, the IRS will apply a 10% federal tax penalty on the taxable portion of the withdrawal, unless. Variable annuities defer the recognition of earnings and gains for income tax purposes, providing significantly more tax-deferred growth over time. You do not receive a tax deduction on the money you deposit, however, you pay no taxes until you begin making withdrawals. There are no annual contribution. Variable Annuities – The value of variable annuity payments changes with stock market fluctuations, making it impossible to pinpoint exact taxes. That said. But if you inherit a qualified annuity and withdraw the money, taxes will be due. This type of rider is usually found on a variable annuity. There are. Income withdrawn from all types of deferred annuities is taxed as “ordinary income,” not long-term capital gain income. This tax treatment applies to fixed-rate. Before the contract owner reaches age 59½, withdrawals from an annuity are subject to a penalty on the annuity's gain. That is unless the withdrawal qualifies. When you take your money out of a variable annuity, however, you will be taxed on the earnings at ordinary income tax rates rather than lower capital gains. Variable annuities are not suitable for meeting short-term goals because substantial taxes and insurance company charges may apply if you withdraw your money. That means withdrawals are fully taxable until all of the capital gains and dividends credited are withdrawn. The chart below illustrates LIFO withdrawals.

What Is The Loan

:max_bytes(150000):strip_icc()/Term-Definitions_loan.asp-b51fa1e26728403dbe6bddb3ff14ea71.jpg)

an amount of money that is borrowed, often from a bank, and has to be paid back, usually together with an extra amount of money that you have to pay as a charge. Loans are not permitted from IRAs or from IRA-based plans such as SEPs, SARSEPs and SIMPLE IRA plans. Loans are only possible from qualified plans. A loan is a sum of money borrowed by a company with the agreement to pay the lender back within a specific period of time. There are many types of loans. We provide a home loan guaranty benefit and other housing-related programs to help you buy, build, repair, retain, or adapt a home for your own personal. Loans are a type of financial aid that enables students and parents to borrow money to pay for their educational expenses. How do personal loans work? Once you're approved for a personal loan, the cash is usually delivered directly to your checking account. If you're getting a loan. What is a Loan? A loan is money borrowed from a bank or financial institution. The borrower agrees to pay back the principal amount of the loan plus interest. What Is A Mortgage? · A mortgage is a loan from a lender that gives borrowers the money they need to buy or refinance a home. The borrower agrees to pay back. A loan is a debt incurred by an individual or some entity. The other party in the transaction is called a lender - it is usually a government, financial. an amount of money that is borrowed, often from a bank, and has to be paid back, usually together with an extra amount of money that you have to pay as a charge. Loans are not permitted from IRAs or from IRA-based plans such as SEPs, SARSEPs and SIMPLE IRA plans. Loans are only possible from qualified plans. A loan is a sum of money borrowed by a company with the agreement to pay the lender back within a specific period of time. There are many types of loans. We provide a home loan guaranty benefit and other housing-related programs to help you buy, build, repair, retain, or adapt a home for your own personal. Loans are a type of financial aid that enables students and parents to borrow money to pay for their educational expenses. How do personal loans work? Once you're approved for a personal loan, the cash is usually delivered directly to your checking account. If you're getting a loan. What is a Loan? A loan is money borrowed from a bank or financial institution. The borrower agrees to pay back the principal amount of the loan plus interest. What Is A Mortgage? · A mortgage is a loan from a lender that gives borrowers the money they need to buy or refinance a home. The borrower agrees to pay back. A loan is a debt incurred by an individual or some entity. The other party in the transaction is called a lender - it is usually a government, financial.

loan noun (SUM) an amount of money that is borrowed, often from a bank, and has to be paid back, usually together with an extra amount of money that you have. A loan is money or other goods that an individual borrows from a lender and agrees to pay back the borrowed sum in equated monthly instalments (EMIs). Assuming one of these loans, rather than taking out a brand new mortgage, could save you tens of thousands of dollars over the life of that loan. Additionally. A loan is a contract between a borrower and a lender in which the borrower receives an amount of money (principal) that they are obligated to pay back in the. In finance, a loan is the transfer of money by one party to another with an agreement to pay it back. The recipient, or borrower, incurs a debt and is usually. Small Dollar Loan Program › The Small Dollar Loan Program was created to help Certified CDFIs provide alternatives to high cost small dollar loans. Impact. What is a home equity line of credit? A HELOC provides ongoing access to funds. Unlike a conventional loan a HELOC is a revolving line of credit, allowing you. Key Takeaways · Personal loans are loans that can cover a number of personal expenses. · You can find personal loans through banks, credit unions, and online. Kiva is the world's first online lending platform. For as little as $25 you can lend to an entrepreneur around the world. Learn more here. Although the student loan is not forgiven, agencies may make payments to the loan holder of up to a maximum of $10, for an employee in a calendar year and a. A loan is based on the borrower's specific need, such as the purchase of a car or a home. Credit lines can be used for any purpose. On average, closing costs . A loan is a financial product that allows a user to access a fixed amount of money at the outset of the transaction, with the condition that this amount, plus. $57, for undergraduates-No more than $23, of this amount may be in subsidized loans. $, for graduate or professional students-No more than $65, noun the act of lending; a grant of the temporary use of something: the loan of a book. something lent or furnished on condition of being returned. But there are differences in how you receive funds and how you pay them back. A loan gives you a lump sum of money that you repay over a period of time. A line. A mortgage is a type of loan you use to buy property, such as a home. A financial institution or “lender” will give you money and they will require you to use. heyco-instrument.ru can help you start your search for government loans. Browse by category to see what loans you may be eligible for today. Loan structure refers to the different characteristics that a lender can choose from when extending credit to a borrower. This Loan Payment Calculator computes an estimate of the size of your monthly loan payments and the annual salary required to manage them without too much. Let FHA Loans Help You FHA loans have been helping people become homeowners since How do we do it? The Federal Housing Administration (FHA) - which is.

How To Start A Small Hedge Fund

You need $50mln and 3 years of track record. Otherwise you are on your own. Networking as you said will only get you friends of friends to invest but no. However, a mini-prime broker or. “introducing broker” acts as a liason between a hedge fund and the large prime brokers, providing startup fund managers access. 1. Define your strategy · 2. Incorporate · 3. Complete the proper registrations · 4. Write your investment agreement · 5. Get your team together · 6. Market yourself. Low commission rates start at $0 for U.S. listed stocks & ETFs*. Margin loan Depending on the client's investment objective, certain hedge fund. So, for about $4k (instead of $k per year) you can start a hedge fund. You seed this with your own money and do your strategy for Here's a brief summary of the chronological steps necessary to launch a hedge fund: · Define the fund's investment objectives and strategy. How to Start a Hedge Fund: Who's Qualified to Do It, How to Raise Capital and Form the Fund, How to Hire and Survive the Job, and Exit Options If It Fails. The size of a hedge fund is usually determined by the total value of its assets under management (AUM). However, since there is no upper limit to how big hedge. This Hedge Fund Start-Up Guide is designed to help fill the gap. Drawing on advice from both investors and managers, it provides practical advice for all. You need $50mln and 3 years of track record. Otherwise you are on your own. Networking as you said will only get you friends of friends to invest but no. However, a mini-prime broker or. “introducing broker” acts as a liason between a hedge fund and the large prime brokers, providing startup fund managers access. 1. Define your strategy · 2. Incorporate · 3. Complete the proper registrations · 4. Write your investment agreement · 5. Get your team together · 6. Market yourself. Low commission rates start at $0 for U.S. listed stocks & ETFs*. Margin loan Depending on the client's investment objective, certain hedge fund. So, for about $4k (instead of $k per year) you can start a hedge fund. You seed this with your own money and do your strategy for Here's a brief summary of the chronological steps necessary to launch a hedge fund: · Define the fund's investment objectives and strategy. How to Start a Hedge Fund: Who's Qualified to Do It, How to Raise Capital and Form the Fund, How to Hire and Survive the Job, and Exit Options If It Fails. The size of a hedge fund is usually determined by the total value of its assets under management (AUM). However, since there is no upper limit to how big hedge. This Hedge Fund Start-Up Guide is designed to help fill the gap. Drawing on advice from both investors and managers, it provides practical advice for all.

To start a U.S. hedge fund, you generally need to form two business entities: the hedge fund, and its investment manager. The hedge fund is typically set up as. Hedge funds were not designed with the average investor in mind. For the majority of investors, participating in a hedge fund will be difficult because. hedge funds are but a small part Hedge funds became particularly fashionable starting in , a year of favorable press commentary on the Tiger Fund. You can use any brokerage firm to launch your incubator fund. As soon as the fund has been established and you have received the organizational documentation. Starting a hedge fund typically requires significant experience in finance, a strong track record, and substantial capital. 1. Define your strategy · 2. Incorporate · 3. Complete the proper registrations · 4. Write your investment agreement · 5. Get your team together · 6. Market yourself. own determinations regarding the suitability of hedge funds. It is likely that many hedge funds are not suitable investments for small or retail investors. Smaller and more entrepreneurial managers help encourage competition, which can only be a good thing for investors. Further, there is a large pool of investors. Creating a legal and structural framework at the outset that is in tune with the fund's investment objectives and investor base is the foundation for a. Creating a legal and structural framework at the outset that is in tune with the fund's investment objectives and investor base is the foundation for a. Establishing a hedge fund is expensive and the laws are cumbersome. Here's a step-by-step guide to getting there. You need $50mln and 3 years of track record. Otherwise you are on your own. Networking as you said will only get you friends of friends to invest but no. Four Steps to Starting a Hedge Fund or Private Equity Fund · Step One: Set Up Your Core Team · Step Two: Define Your Investment Strategy · Step Three: Raise. own determinations regarding the suitability of hedge funds. It is likely that many hedge funds are not suitable investments for small or retail investors. The 3(c)(1) fund is geared mostly toward managers who will cater to high-net-worth or accredited investors, small family offices, foundations, or funds of funds. Creating a Hedge Fund Entity · Step 1 Hire a law firm. Niche strategies hedge funds concentrate on specific, small market niches. investment option in its own right. Similar to a multi-strategy fund. Once you're approved, you'll be able to start investing with friends in a matter of seconds. Your cash & investments are always held in your own brokerage. The procedure to establish a hedge fund in the United States follows a well-defined path because these alternative investment products have been in place for. The hedge fund industry is concentrated in the largest funds, and the big funds are getting bigger. In time, some of these funds will not survive their founders.

What Is The Current Stock Market Rate

Dow Jones. 40, % ; S&P 5, +% ; Nasdaq. 17, +% ; Russell. 2, % ; VIX. %. Market Highlights. Market Status, Closed. Current Index, 79, Change, Percent Change, %. High, 79, Low, 78, Volume, ,, U.S. STOCKS ; Nasdaq Composite, , ; S&P , , ; DJ Total Stock Market, , ; Russell , , Stock Spotlight ; Most Actives · NVIDIA CORP. $ ; Top Gainers · DOLLAR GENERAL CORP. $ ; Top Losers · BROADCOM INC. $ Markets Data ; TSX Composite Index increase · 23, ; TSX Venture Composite Index increase · ; Dow Jones Industrials Average increase · 40, ; Dow. Markets Performance ; Commodities. Future, Last ; Currencies. Exchange, Last ; Rates & Bonds. Name, Yield. Dow Jones Futures 40, (%) · Nasdaq 16, (%) · S&P 5, (%) · ECONOMIC CALENDAR · INR · USDT · WRX · BTC. CNBC is the world leader in business news and real-time financial market coverage. Find fast, actionable information. Today's market ; NYSE COMPOSITE (DJ), 18,, (%) ; NYSE U.S. INDEX, 16,, (%) ; DOW JONES INDUSTRIAL AVERAGE, 40, Dow Jones. 40, % ; S&P 5, +% ; Nasdaq. 17, +% ; Russell. 2, % ; VIX. %. Market Highlights. Market Status, Closed. Current Index, 79, Change, Percent Change, %. High, 79, Low, 78, Volume, ,, U.S. STOCKS ; Nasdaq Composite, , ; S&P , , ; DJ Total Stock Market, , ; Russell , , Stock Spotlight ; Most Actives · NVIDIA CORP. $ ; Top Gainers · DOLLAR GENERAL CORP. $ ; Top Losers · BROADCOM INC. $ Markets Data ; TSX Composite Index increase · 23, ; TSX Venture Composite Index increase · ; Dow Jones Industrials Average increase · 40, ; Dow. Markets Performance ; Commodities. Future, Last ; Currencies. Exchange, Last ; Rates & Bonds. Name, Yield. Dow Jones Futures 40, (%) · Nasdaq 16, (%) · S&P 5, (%) · ECONOMIC CALENDAR · INR · USDT · WRX · BTC. CNBC is the world leader in business news and real-time financial market coverage. Find fast, actionable information. Today's market ; NYSE COMPOSITE (DJ), 18,, (%) ; NYSE U.S. INDEX, 16,, (%) ; DOW JONES INDUSTRIAL AVERAGE, 40,

* Looking ahead, inflation will be in focus for markets with the release of consumer price index (CPI) inflation on Wednesday. Softening labor market led to a. Discover the U.S. markets today with Fox Business. See the trending stocks in the USA stock market and today's stock market results. Market Highlights. Market Status, Closed. Current Index, 79, Change, Percent Change, %. High, 79, Low, 78, Volume, ,, This may impact the share price and makes for a busy trading day. Review months. March; June; September; December. FTSE At Yahoo Finance, you get free stock quotes, up-to-date news, portfolio management resources, international market data, social interaction and mortgage. To insert a stock price into Excel, first convert text into the Stocks data type. Then you can use another column to extract certain details relative to that. US/America: Updated stock indexes in US, North/Latin Americas. Get an overview of major indexes, current values and stock market data in US, Brazil, Canada. Share Market Today - Stock Market and Share Market Live Updates: Get all the latest share market and India stock market news and updates on. The term stock price refers to the current price that a share of stock is trading for on the market. Every publicly-traded company, when its shares are issued. The S&P Index ($SPX) (SPY) today is up +%, the Dow Jones Industrials Index ($DOWI) (DIA) is down %, and the Nasdaq Index ($IUXX) (QQQ) is. U.S. Market Data ; NASDAQ Composite Index, 16,, ; S&P Index, 5,, ; Global Dow Realtime USD, 4,, ; Gold Continuous Contract. Top U.S. Markets ; 16,, +, +%Positive ; 5,, , %Negative. Stock Quote: NASDAQ: AAPL · Day's Open · Closing Price · VolumeM · Intraday High · Intraday Low Equity indices ; S&P , 5,, + +%. Today. 4,Oct 27 ,Jul 16 Opens in 40 min ; Dow, 40,, %. Today. Realtime Prices for Dow Jones Stocks ; Amgen, %. ; Apple, %. Updated world stock indexes. Get an overview of major world indexes, current values and stock market data Value, Net Change, % Change, 1 Month, 1 Year. A stock market site by Business Insider with real-time data, custom charts and breaking news. Get the latest on stocks, commodities, currencies, funds. stock market news, stock market data and trading information U.S. Steel Stock Is Jumping Because Wall Street Sees Value. Sept. 6, Dow Industrials 40, ; S&P 5, ; Russell 2, ; NASDAQ Reduced Value Index 3, ; NYSE Composite. Major Indices ; JPX-Nikkei Mid and Small Cap Index, 18,, , %, 18, ; Tokyo Stock Exchange Growth Market Index, , , %.

How To Open A Student Checking Account Td Bank

To qualify, you generally need to be in high school or college or be years old. Most banks don't charge monthly maintenance fees for student checking. To open a checking account, you must provide government-issued identification with your photo, your Social Security card or Taxpayer Identification Number, and. Simplify your banking experience and save time with TD Bank. Open a TD Student Bank Account and easily add on a TD Simple Savings account in one. If you satisfy the criteria, you can open an account with these financial institutions. . What are the best bank accounts for F1 visa holders in the U.S.? The. Earn $ Bonus will be paid on or before days after account opening. Best for student or young adult ages 17 through Upon the primary account holders. 4. How to open a bank account · Your full name, home address, home telephone number, your campus telephone number and your college address · Your passport · An I-. We've created this easy to follow outline of services, fees and policies to help you understand how this account works. All of our accounts also include. The TD Student Chequing Account can be the ideal account for kids and teens to learn the benefits of saving while enjoying the convenience of unlimited. Open a new TD Student Chequing Account between May 7, , and October 31, , (the “New Account”) and complete any three of the following with the new. To qualify, you generally need to be in high school or college or be years old. Most banks don't charge monthly maintenance fees for student checking. To open a checking account, you must provide government-issued identification with your photo, your Social Security card or Taxpayer Identification Number, and. Simplify your banking experience and save time with TD Bank. Open a TD Student Bank Account and easily add on a TD Simple Savings account in one. If you satisfy the criteria, you can open an account with these financial institutions. . What are the best bank accounts for F1 visa holders in the U.S.? The. Earn $ Bonus will be paid on or before days after account opening. Best for student or young adult ages 17 through Upon the primary account holders. 4. How to open a bank account · Your full name, home address, home telephone number, your campus telephone number and your college address · Your passport · An I-. We've created this easy to follow outline of services, fees and policies to help you understand how this account works. All of our accounts also include. The TD Student Chequing Account can be the ideal account for kids and teens to learn the benefits of saving while enjoying the convenience of unlimited. Open a new TD Student Chequing Account between May 7, , and October 31, , (the “New Account”) and complete any three of the following with the new.

Step 1 Open a TD Beyond Checking account. Step 2 Set up direct deposits. Step 3 Have $2, in qualifying direct deposits post to the. How to open the checking account · Enter your personal information, including proof of address, and employment type · Request (if available) a debit card for. Explore your personal banking options at TD Canada Trust. Open a savings or chequing account or find out more. TD Bank, Boylston St, Boston, MA Student Financial Services. Student Financial Services offers a wide range of services, including: Student Accounts. Open a TD Complete Checking account. Make 15 qualifying debit card purchases within 60 days of opening account. Earn $ Bonus will be paid on or before Students can be set up with a Student Checking. Account that Parents who set up an account with TD Bank will be provided online access to their child's. Waive the $10 monthly fee by maintaining a minimum daily balance of $ Interest-bearing account. Free checks. No minimum opening deposit. TD Bank Checking vs. Open a TD Checking Account online in minutes—it's easy and secure. With accounts built for every stage of life, you'll get free Online Banking, Mobile Banking. Explore your personal banking options at TD Canada Trust. Open a savings or chequing account or find out more. bonus available to eligible new TD Bank customers when opening a TD Convenience Checking account Checking SM, TD 60+ CheckingSM, TD Premier CheckingSM, TD. Teens who are 14 years old and older can open a TD Student Chequing Account without a parent or legal guardian. They will need one (1) valid photo ID, such. Enjoy student banking benefits and achieve your savings goals by opening a student chequing and every day savings banking account with overdraft protection. Customers under 23 years of age can open and continue to keep this account without proof of enrollment until the age of Customers 23 years of age or older. Most banks will allow you to open an account online, although you may have to visit a branch or provide additional paperwork if you haven't had a bank account. Start by opening a new TD Student Chequing Account and your child could get $25 cash. Learn more. Eligibility Requirements: Find out if you're eligible and. H2: Key features of the student chequing account at TD Bank · Keep the account with no monthly fee until age 23 · After age 23 no monthly fee with proof of. Please note: If you would like to change your account type to a TD Student Chequing Account, please contact EasyLine telephone banking or visit the nearest TD. Maintain a $ minimum daily balance. · Link your savings account to a TD Beyond, TD Relationship, or TD Student checking account. · If you are under the age of. You can only use your TD Student Chequing Account as long as you're under 23 years old, or a full-time post-secondary student in an accredited college or. Have your friend open a personal checking account with the referral form at a nearby TD Bank store. Within 60 days of account opening, your friend must either.

Adtalem Stock

Real time Adtalem Global Education (ATGE) stock price quote, stock graph, news & analysis. Adtalem Global Education Inc. provides workforce solutions worldwide. It operates through three segments, Chamberlain, Walden, and Medical and Veterinary. Adtalem Global Education Inc. · · Partner Center · Your Watchlists · Recently Viewed Tickers · ATGE Overview · Key Data · Performance · Analyst Ratings. View live Adtalem Global Education Inc. chart to track its stock's price action. Find market predictions, ATGE financials and market news. View the most recent data and latest information on option chains for Adtalem Global Education Inc. Common Stock (ATGE) at heyco-instrument.ru Complete Adtalem Global Education Inc. stock information by Barron's. View real-time ATGE stock price and news, along with industry-best analysis. Adtalem Global Education is a workforce solutions provider that focuses on Stock Information. NYSE: ATGE. Change ($). (). Change (%). (). Discover real-time Adtalem Global Education Inc. Common Stock (ATGE) stock prices, quotes, historical data, news, and Insights for informed trading and. Stock Quote. Overview · Press Releases and News · Events · Stock Information · Stock Quote · Stock Chart · Historical Stock Quote · Investment Calculator. Real time Adtalem Global Education (ATGE) stock price quote, stock graph, news & analysis. Adtalem Global Education Inc. provides workforce solutions worldwide. It operates through three segments, Chamberlain, Walden, and Medical and Veterinary. Adtalem Global Education Inc. · · Partner Center · Your Watchlists · Recently Viewed Tickers · ATGE Overview · Key Data · Performance · Analyst Ratings. View live Adtalem Global Education Inc. chart to track its stock's price action. Find market predictions, ATGE financials and market news. View the most recent data and latest information on option chains for Adtalem Global Education Inc. Common Stock (ATGE) at heyco-instrument.ru Complete Adtalem Global Education Inc. stock information by Barron's. View real-time ATGE stock price and news, along with industry-best analysis. Adtalem Global Education is a workforce solutions provider that focuses on Stock Information. NYSE: ATGE. Change ($). (). Change (%). (). Discover real-time Adtalem Global Education Inc. Common Stock (ATGE) stock prices, quotes, historical data, news, and Insights for informed trading and. Stock Quote. Overview · Press Releases and News · Events · Stock Information · Stock Quote · Stock Chart · Historical Stock Quote · Investment Calculator.

Stock Chart ; August 26, , $ ; August 23, , $ ; August 22, , $ ; August 21, , $

View the latest ATGE share price or buy & sell Adtalem Global Education stock on NYSE using Lightyear. Adtalem Global Education Inc is an American. Based on 4 Wall Street analysts offering 12 month price targets for Adtalem Global Education in the last 3 months. The average price target is $ with a. Get the latest Adtalem Global Education Inc (ATGE) real-time quote, historical performance, charts, and other financial information to help you make more. View today's Adtalem Global Education Inc stock price and latest ATGE news and analysis. Create real-time notifications to follow any changes in the live. Adtalem Global Education Inc ATGE:NYSE ; Open ; Day High ; Day Low ; Prev Close ; 52 Week High In depth view into ATGE (Adtalem Global Education) stock including the latest price, news, dividend history, earnings information and financials. Historical daily share price chart and data for Adtalem Global Education since adjusted for splits and dividends. The latest closing stock price for. Historical Stock Quote · Stock Quote · Stock Chart · Historical Stock Quote · Investment Calculator · Financials · Quarterly Results · Annual Reports · SEC. Adtalem Global Education ; Market Cap. $B ; P/E Ratio (ttm). ; Forward P/E · ; Diluted EPS (ttm). ; Dividends Per Share. N/A. Track Adtalem Global Education Inc (ATGE) Stock Price, Quote, latest community messages, chart, news and other stock related information. Discover historical prices for ATGE stock on Yahoo Finance. View daily, weekly or monthly format back to when Adtalem Global Education Inc. stock was issued. Adtalem Global Education Inc.'s stock symbol is ATGE and currently trades under NYSE. It's current price per share is approximately $ Stock Information · Stock Quote · Stock Chart · Historical Stock Quote · Investment Calculator · Financials · Quarterly Results · Annual Reports · SEC Filings. Analysts' recommendations: Adtalem Global Education Inc. · Barrington Research Adjusts Adtalem Global Education's PT to $90 From $70, Keeps Outperform Rating. ATGE - Adtalem Global Education Inc - Stock screener for investors and traders, financial visualizations. See the latest Adtalem Global Education Inc stock price (ATGE:XNYS), related news, valuation, dividends and more to help you make your investing decisions. Get Adtalem Global Education Inc (ATGE.N) real-time stock quotes, news, price and financial information from Reuters to inform your trading and investments. Adtalem Global Education Inc (ATGE) stock price, GURU trades, performance, financial stability, valuations, and filing info from GuruFocus. Adtalem Global Education stock price, live market quote, shares value, historical data, intraday chart, earnings per share and news. Stock analysis for Adtalem Global Education Inc (ATGE:New York) including stock price, stock chart, company news, key statistics, fundamentals and company.